Tenant Protection

When you care enough about your belongings to store them, you probably care enough to keep them protected in the event of theft, vandalism, weather damage, and more.

Your self storage lease likely states that “the tenant assumes full risk for damage or loss of stored goods." Translation: you're out of luck if your leather sofa is ruined by a roof leak or if your prized collection of tools is stolen. With Storelocal Protection, we've got you covered! Speak to the facility manager to add up to $5,000 of protection to your monthly lease today.

Storelocal Protection Coverage Levels:

$12 per mo. | $2,500 of Coverage

$15 per mo. | $3,500 of Coverage

$18 per mo. | $5,000 of Coverage

Frequently Asked Questions

What's covered?-20221004-153020.png)

Storelocal Protection will pay the current replacement value of your damaged or stolen goods up to your policy limit. Any item NOT listed in the exclusions is covered.

What's excluded?

Yes, there's some fine print. Ask your manager for a copy of the addendum to read the list of exclusions. Make sure to read it carefully. It's not exciting, but it's important. Again, anything NOT listed in the addendum IS covered.

I have homeowners or renters insurance. Can I use that instead?

If your homeowners insurance covers offsite storage, yes! However, you likely have a deductible. The most common deductible is $1,000, but yours may be more or less. Filing an insurance claim may also cause your insurance rates to rise for the next few years. Storelocal Protection has no deductible and will not affect your insurance rates. It also pays claims for your damaged property at current replacement value, not the depreciated value insurance policies use. That is, we'll make you whole, not offer you $100 for an item you paid $700 for last year.

I need more than $5,000 in coverage. What should I do?

First, speak with the facility manager for consent to store property of greater value than $5,000. If consent is granted, there are many insurance options available. We partner with Deans & Homer which offers self storage insurance up to $50,000 per unit.

To purchase $7,500 to $50,000 of insurance for your self storage unit, go to https://storage.insureyourstuff.com/ and search for your facility by city and state. If the facility you're storing at is not in the database, let your manager know and they can help get it added. To see pricing, click on “Instant Quote” in the top menu.

How do I file a claim?

Storelocal Protection claims can be filed at www.storelocalclaims.com.

How do I know if my claim was filed successfully?

A successfully submitted claim will have a confirmation page, like this:You'll also receive a confirmation email, like this:

You'll also receive a confirmation email, like this:

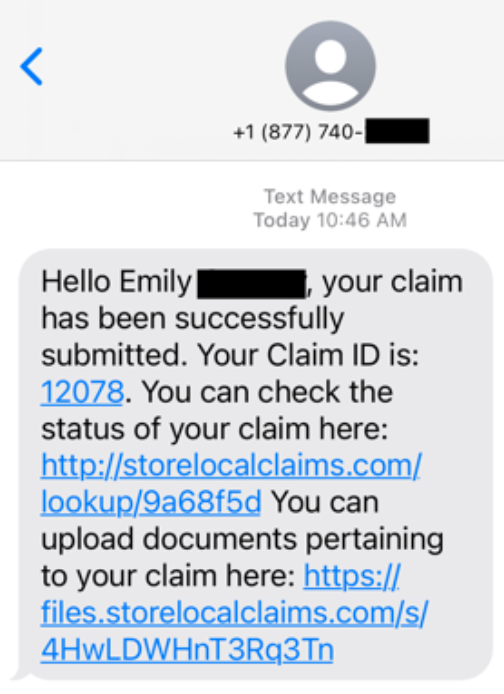

And if you opted to receive text messages, the confirmation text will look like this:

How long does the claims process take?

ClaimsPros, our third party claims administrator, will contact the facility manager for proof of coverage and a claims report within one business day of receiving your claim. ClaimsPros typically pays claims within 24-48 hours of receiving completed documentation from the tenant and the manager.

Additional questions?

Speak to the facility manager where you're storing to learn more about Storelocal Protection.

_______________________________